Introduction

Personal finance has become a major priority in 2025 as people look for smarter ways to save, invest, and track daily spending. With the rise of digital banking and AI-powered finance tools, managing money is easier and more convenient than ever.

Below are four of the most trusted, widely used finance apps helping millions take control of their financial life.

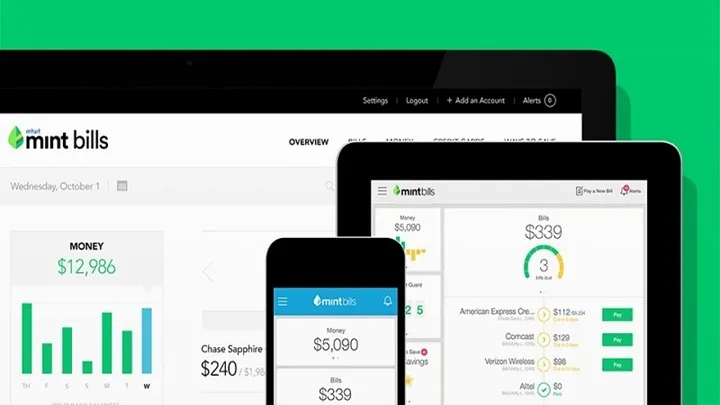

1. Mint – The Most Popular Budgeting App

Mint remains a global favorite for money tracking. It automatically connects to your bank accounts, categorizes spending, and shows a full picture of your financial health.

Why users trust it

- Automatic expense tracking

- Custom budgets for different categories

- Alerts for unusual spending

- Monthly financial reports

- Easy-to-read charts and insights

Best for: Anyone who wants a clear, simple overview of their spending habits.

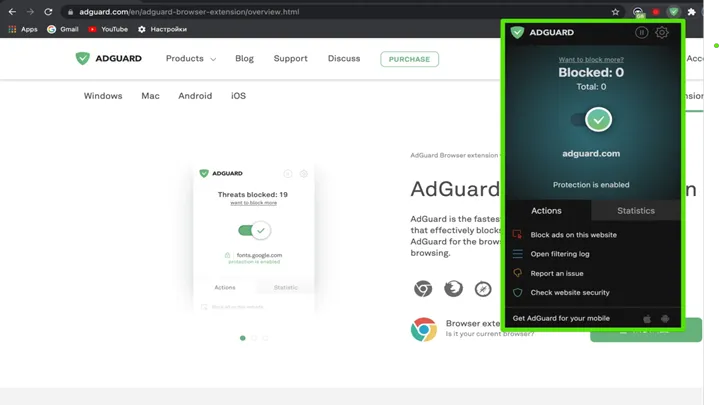

2. Revolut – Smart Banking for Everyday Life

Revolut has grown into one of the most-used finance apps thanks to its powerful features for spending, saving, and traveling.

Key benefits

- Multi-currency accounts with great exchange rates

- Built-in analytics for spending

- Virtual cards for online shopping security

- Savings vaults for automated goals

- Fast transfers worldwide

Best for: Travelers, online shoppers, and users who need flexible digital banking.

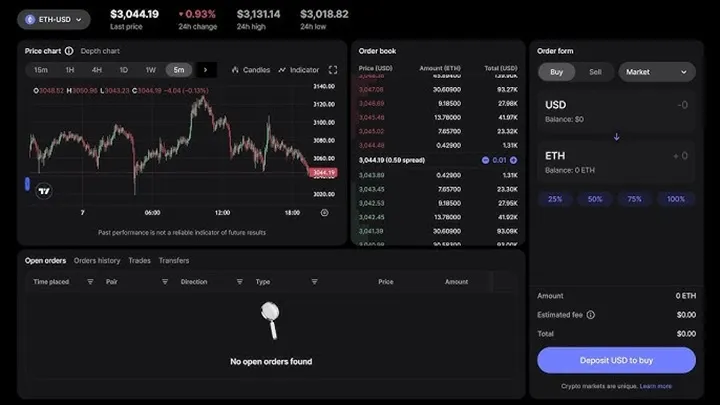

3. Robinhood – Easy Investing for Beginners

Robinhood continues to be one of the most popular platforms for stock and crypto investing due to its simple interface and no-commission trading.

What makes it standout

- Ultra-clean dashboard for beginners

- Fractional shares for low-cost investing

- Crypto and stock trading in one place

- Real-time market data

- Learning tools for new investors

Best for: New investors who want a simple, low-barrier investment platform.

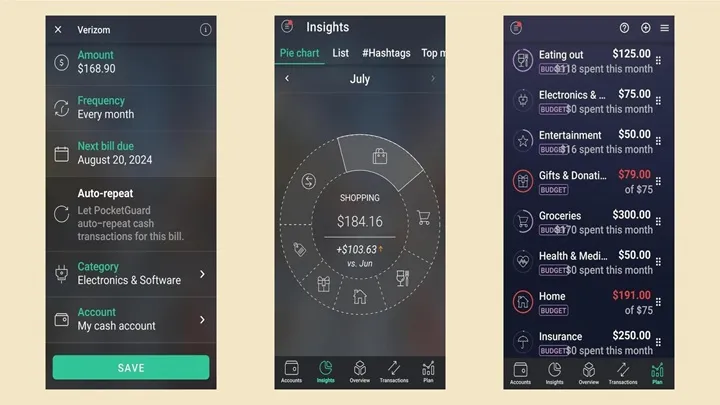

4. PocketGuard – Control Overspending Effortlessly

PocketGuard focuses on helping users avoid overspending by showing exactly how much they can safely spend after bills and goals.

Why people love it

- “In My Pocket” feature shows real disposable money

- Smart bill tracking

- Goal-based budgeting

- Simple visual overview of cash flow

- Alerts to prevent going over budget

Best for: Users who struggle with overspending or want tighter control of daily expenses.

Conclusion

Managing money in 2025 doesn’t have to be complicated. With the help of powerful apps like Mint, Revolut, Robinhood, and PocketGuard, anyone can budget smarter, invest easier, and build stronger financial habits. These four apps have become everyday essentials for people who want full control over their financial future.